ONLINE ACCOUNTING

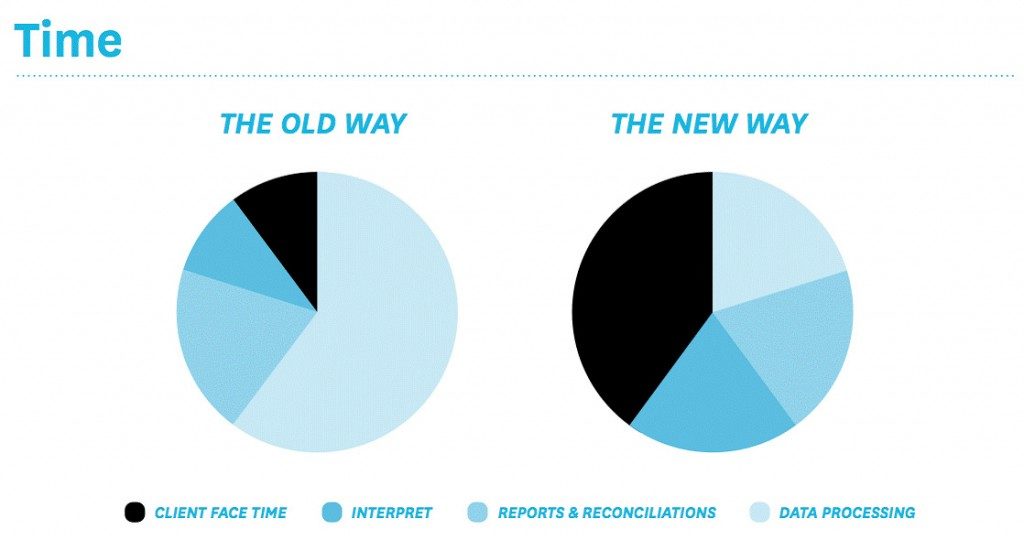

Access your accounts and run your business from anywhere in the world on a PC, Mac or popular mobile devices. The Dashboard gives a real-time view of your business at a glance with a snapshot of all your transactions. Easily enter expense claims and manage personal expenditure. Come along with us as we take the new way in looking after small businesses.

OUR SERVICES

We offer a range of high-quality accounting, financial and business services. At BDS Hughes, we understand that no two clients are the same. We would be delighted to meet with you to determine how you can make best use of our team and the services we provide. View All Services

OUR SERVICES

We offer a range of high-quality accounting, financial and business services. At BDS Hughes, we understand that no two clients are the same. We would be delighted to meet with you to determine how you can make best use of our team and the services we provide. View All Services